There are two cores that complement each other in producing improvement in the long term wealth: financial planning and insurance. Collectively, they form a strong base with wonderful potential to give people security in having their financial resources available for them when they want it. Financial planning encompasses saving and investing money over time, and commanding all resources. And then, there is insurance, which imparts this protection to minimize the risks that may be a threat to financial stability. Using both of them in combination, it is these two strategies that create and accumulate your wealth in the long haul.

This blog will go through how financial planning and insurance complement each other, their importance in integration, and what they work towards protecting your assets.

What’s the Major Role For Financial Planning Under Wealth Building

Financial planning essentially encompasses all aspects of finance, not merely setting some financial goals, having strategies on how to achieve them, and managing your finances so that it leads to the ultimate successful long-term accomplishment. Be it for retirement savings, buying a house, or creating an emergency fund, financial planning clearly shows the ability of having money working for you in order for you to make the proper decisions in life.

1. Setting Financial Goals:

The first step in financial planning is having clear, measurable financial goals. It might be short-term pay-off of some debt or saving up for a vacation; it may also be long-term, like retirement or funding the education of your children. It gives you a kind of roadmap regarding where your money should go and how to devise strategies for the achievement of these goals.

2. Managing Cash Flow and Budgeting:

One has to manage one’s cash flow for an effective financial plan. You must work up and live by a budget, hence the need to manage your income and expenses, ensure that you save enough and invest enough for the achievement of monetary goals. A budget maintained well will guarantee living within your means and putting money toward your financial security in the future.

3. Investing for Growth:

Investment is one of the most important components of financial planning if you have long-term wealth creation in mind. You may invest through equities, bonds, real estate, and other investments. Your money may multiply with time. A well designed and diversified investment portfolio can create wealth systematically and sustainably.

4. Retirement Planning:

Saving up to retire is a big part of any financial plan. With the use of retirement accounts, whether it’s an IRA or 401(k), making consistent contributions will pave the way toward generating enough money to sustain you when retirement finally becomes reality. Planning early ensures that compound interest and long-term growth are well utilized.

The Importance of Insurance in Financial Planning

Since financial planning is all about accumulation, an integral role for wealth preservation comes from insurance. Even if your money management skills were extremely good, life will always have some unexpected events like illness, accident, or death, which may considerably destroy your financial plans. Insurance helps protect these assets and income, allowing you to continue working toward your financial goals even if life gets a little weird sometimes.

1. Life Insurance for Income Protection:

Life insurance is actually the most outstanding ingredient of a protection product that will provide for those that you left behind. This would ensure that your family will not be tormented at the expense of the monetary consequences of your death. This way, your quality of life should not and will not have to compromise, or your family will not have to continue paying debts or funding for educational expenses. Since you have that insurance for life, you already know well that the present and future income-generating capabilities for your family would be secured during your absence.

2. Health Insurance and Medical Expenses:

Health insurance covers you against high-cost medical treatments and healthcare cost. Without proper health coverage, even a single medical emergency could upset your savings and derail your overall financial plan. Health insurance is not only only for regular medical check-ups but also for preventing unexpected bills of medical accidents or illness.

3. Disability Insurance for Income Continuity:

Disability insurance secures that in case of sickness or injuries, you will be receiving some form of income. Such a form of insurance is very important to ensure you continue paying for the costs of living and saving money despite not earning.

4. Home and Auto Insurance for Asset Protection:

Home and automobiles may very well be the costliest belongings someone has in their lives. House insurance and construction insurance would safeguard this investment against any damage or loss caused through theft, natural calamities, and car accidents through fire. Car insurance safeguards you from every incident or car theft. Such insurance ensures you will not cough up a fortune to pay for the repair or replacement.

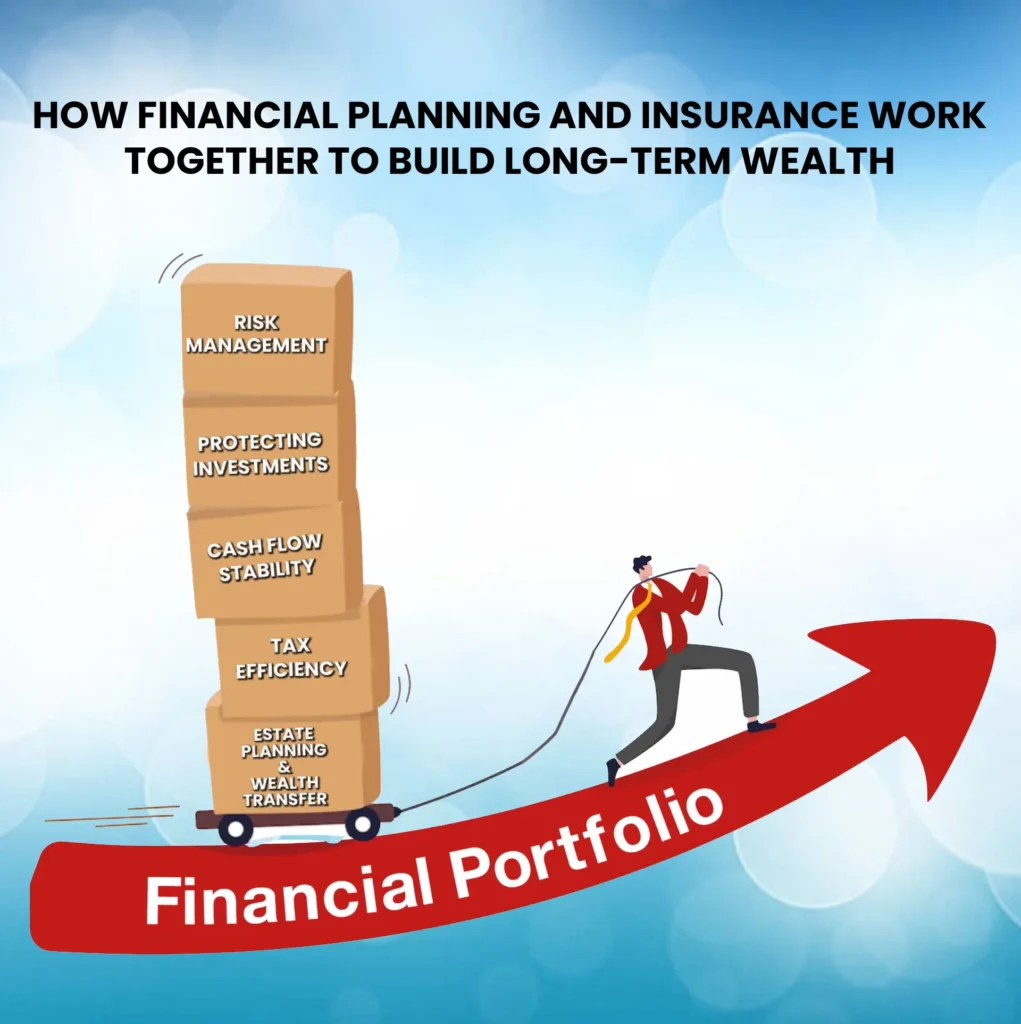

How Does Financial Planning and Insurance Work Together

While financial planning sought to build up as much of your wealth as possible, and then more, insurance ensured that the fruits of all your labor were protected..

Because a financial plan is never complete without proper protection, these complement each other. Let us explain how this works:

1. Risk Mitigation:

Mitigation of financial risk is one of the functions at the core that an insurance policy does. A financial plan includes investing and saving for future needs, but it also acknowledges that risks do exist, may it be medical emergencies, property damage, or losing one’s income because of a disability. Insurance minimizes these risks, providing that you do not need to pull out your savings or investments to pay for things not generally budgeted for and, therefore, refrain from diminishing your financial growth.

2. Income Protection:

Life insurance and disability insurance also represent important components for protecting your income, which is truly the foundation of any financial plan. Without income, you cannot save or invest and thus cannot pay down other debt. Insurance addresses this by ensuring that if you are not able to work, your financial obligations will be taken care of, and your financial plan will stay on track.

3. Safeguarding Investments:

Investments form an integral component of wealth creation in financial planning for a person. Insurance ensures the strategy without jeopardizing investments in the face of uncertainty. For instance, in case of a medical emergency, health insurance may help cover the costs and prevent a dripping in and out of investments. Thus, long-term goals will be preserved, and wealth creation will not be interrupted.

4. Estate Planning and Wealth Transfer:

Another tool in estate planning is insurance. Life insurance, for example, can be used as a source of liquidity to pay estate taxes or debts, which would enable your wealth to pass down to the heirs with minor financial burdens attached to it. Preservation of one’s wealth guarantees that it is passed on smoothly to the next generation.

Steps to Integrate Financial Planning and Insurance

Here’s how you may integrate financial planning and insurance so as to ensure a secure financial future:

1. Assess Your Financial Situation:

You need to assess the income you are making at present, all your expenses, and if you have some savings and investment. Determine your financial goals, whether short-term or long-term, and your risk tolerance. Understanding where you are today helps guide you on what to do next.

2. Identify Key Risks:

Then, think about the risks with which one is exposed in life and how they will affect your financial goals. It could be the risk of dying prematurely, or getting hospitalized by a major illness or losing the job. Insurance is needed to control such risks.

3. Build a Financial Plan:

With the support of a financial advisor, devise a financial plan for you, which in itself sets down and outlines how you’re going to achieve your goals. That includes savings strategies, strategies for investment, debt management, budgeting among many more factors. Come down to risks identified in the plan that may affect the financial plans.

4. Incorporate Insurance into Your Plan:

You should work with an insurance professional to determine what types and amounts of insurance you need to protect your wealth, and of course, these should be financed through life, health, disability, and property insurance. The insurance you have supports your financial plan and protects your assets.

Conclusion

The most important leg to be built up towards your wealth is through financial planning and insurance. While financial planning gives you all the opportunities to save, invest, and prudently use your finances in ways of maximum efficiency possible, insurance will provide a safeguard against risks that are unforeseen. Here, they complement each other as a good strategy toward the building, growth, and protection of long-term wealth. Having these two in your financial planning will enable you to be well-equipped for all the uncertainties in your life, shield you from unforeseen occurrences, and will thus bring about a financially secure future with peace of mind.